I started this blog before we started full-timing but on March 6th 2017 we finished our 6th year of full-timing on the Road of Retirement! Since I haven’t done a budget post about what it costs us to full-time in several years I thought it would be educational to share our 6th year expenses and reflect back upon our earlier expenses to compare how things have changed or remained the same.

I will start this blog by repeating my remarks after our first year of expenses while on the road.

“Back in the year 1999 when I first started planning to retire at the age of 55 my single biggest worry was whether or not we would have enough money to live out our retirement lives in comfort. How much money is enough to full-time seemed to be the overriding question that came up over and over again. As you can imagine there is no universal answer for this. It is much like asking – What is the true meaning of life?”

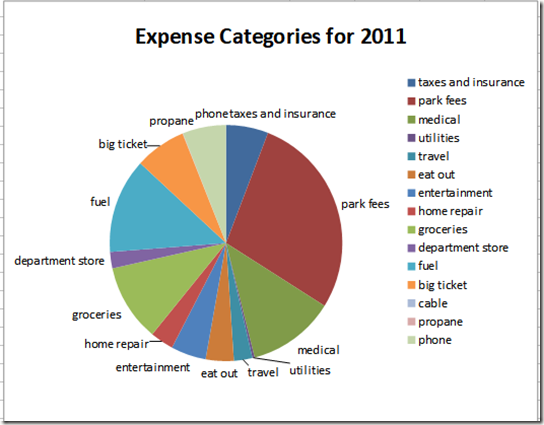

Before discussing what we have learned about our own expenses since we started full-timing in 2011 I would like to talk about this years expenses. For starters our sixth year was our second most economical year on the road (last year was our lowest). Like last year much of the savings can be attributed to the price of both diesel and gas. Like last year another factor was that we stayed in places longer than average.

Our five largest expense categories in order are camp rent, medical, groceries, big ticket items and phone expenses. Since we started full-timing in 2011 both camp rent, medical and groceries have always been our three largest expenses so I would expect this would be true for many people who start out full-timing. The only way to impact these costs are to eat less or camp cheaper (we aren’t going to be able to lower medical expenses). Of course there are ways to do both but we do manage live within our means.

Expect your largest categories of expenses to be Camp Rent, Medical and Groceries!

As I mentioned earlier we did set up an initial budget for what we expected to spend on the road each and every year we planned to full time. A proposed budget is best used as a baseline to see how well you are doing. Our first year on the road we spent nearly 25% more than we had budgeted. From talking with many other “newbie” full-timers we now know this is pretty typical for most people who fulltime after their first year on the road mainly because of the many (and I mean many) unexpected, mostly one-time, startup costs.

“Expect to spend about 25% more your first year on the road than you will spend the years there after!”

So after six years on the road what have we learned? Being a numbers guy I created a spreadsheet which gave rise to our first year budget. A copy of this spreadsheet is free with the purchase of my Ebook - Budgeting for Full Time RV'ers. I have used this spreadsheet each year and have since compared all the annual expenses to see what trends are developing. As any spreadsheet it is a work in progress and has been tweaked over the years.

Below are some key points about our 6 year budget/expenses results that may be useful to others planning on full timing:

- we are averaging $583 per month in camping fees. To put this in perspective we are only members of Passport America and boondock very rarely.

- medical expenses take 13% of our annual budget on average of the last six years. We are lucky here in that I am covered by my previous employer.

- for groceries we budgeted $380 per month and spent on average over 6 years $350 per month or about 12% of our budget. Alcohol purchased at stores is included here.

- expenses I call big ticket items account for about 9.5% of our budget so if you are starting out as new full-timers I would suggest 10% to start with. These are items that are “one-offs” of unexpected one time expenses like a new camera, computer or the addition of solar panels.

- taxes and insurance will take a bit more than 7.5% out of your budget.

- we spent about 11% of our budget on average on diesel for our RV and gasoline for our Honda CRV.

- our phone/internet uses 7% of our budget

- we don’t eat out a lot but eating out and entertainment take about 8% of our annual budget

- all other expense categories were less than 3% on average over six years.

Over the last 6 years we are averaging about 5.6% more per year than we initially projected in 2011. If you factor in inflation we are pretty much spending the same as what we planned to spend. As I mentioned before we were nearly 25% over budget the first year and the remaining years we have been over by 19% in year two, over by 11% in year three, over by 4.4% in year four, under by 16.7% in year five and under by 8.5% this year.

“The above percentages show an interesting trend. Notice that each year our expenses decreased.”

Only in 2016 did we spend more than the previous year however we were still under our proposed initial budget by 8.5% this year. Does this mean things have gotten cheaper? Maybe so with fuel but definitely not with everything else. So why is our expenses decreasing year over year? My best answer is – efficiency!

“Your annual expenses will most likely decrease over time as you become more efficient living life as a full timer.”

Yes we have also become more efficient at finding less expensive stays at campgrounds. We have learned how to navigate new cities and towns to find “happy hour” deals and ways to save money when we buy groceries. We have learned to adopt “free” activities to fill out time such as disc golf , hiking or biking instead of fee based activities. Over time I would expect that every newbie RV’er will over time become more efficient. I think we have now finally gotten to what it actually costs for us to RV fulltime efficiently.

This blog will not and does not answer the question – How much is enough money to fulltime in an RV?

As I stated before there is no universal answer for this question. Simply put each of us spends money differently. My intent with this post is to help show a budgetary baseline and I would suggest that the percentages in the header photo and table above should be a good a baseline for newbie RV’ers starting their planning process. Our data showed us that we can apparently live very comfortably on about $100 per day. As you know everyone’s level of comfort may vary greatly and thus so will their average daily expense.

The best way to use this information is to figure out how much you plan to totally spend when full-timing. Take that number and multiply t by the percentages in the average column above for each category. That will give you an idea of how much it may cost you to full-time. Tweak it as appropriate to your lifestyle and spending habits and then hit the road. It is my hope that our experience helps some future full timers plan better and enjoy the lifestyle we enjoy on the Road of Retirement…